Section 16(a) Beneficial Ownership Reporting Compliance

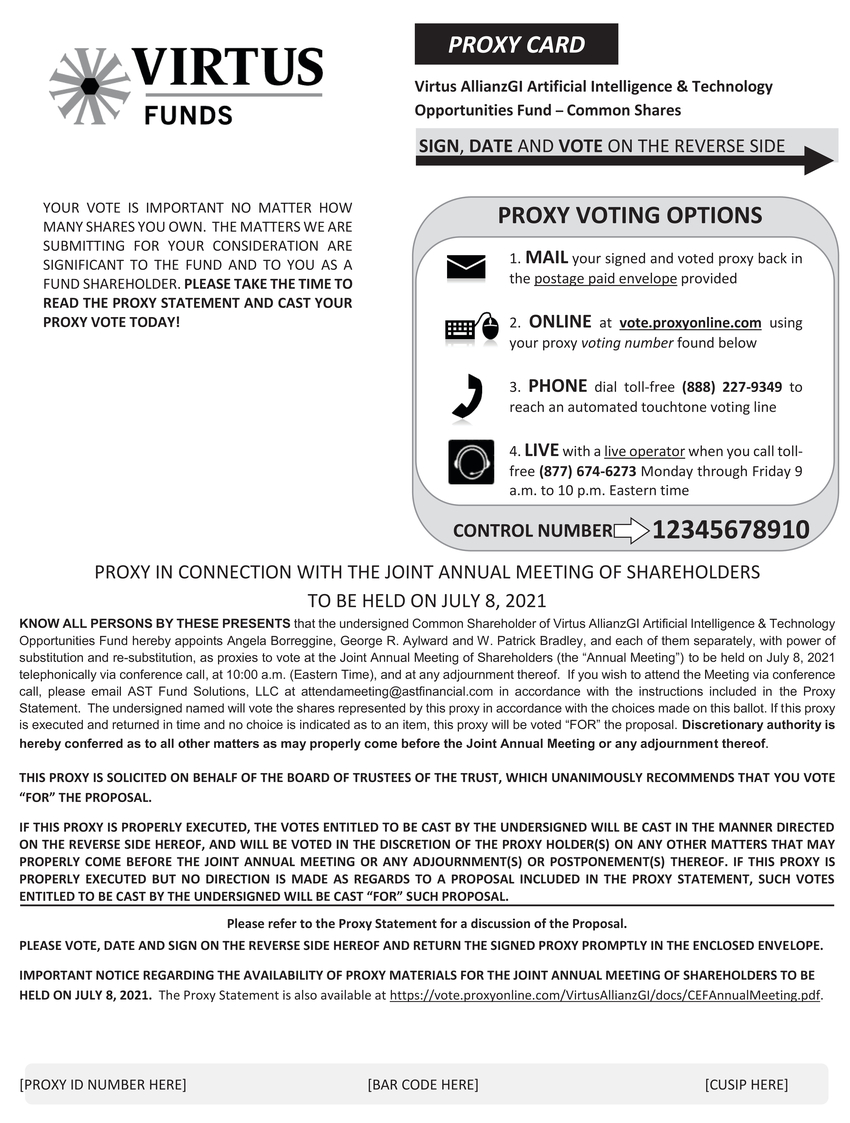

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “1934 Act”) and Subadvisers. Virtus InvestmentSection 30(h) of the 1940 Act require, among other persons, the officers and Trustees of the Funds, Advisers Inc. (the “Adviser”and certain affiliates of the Advisers (“Reporting Persons”) acts as investment adviserto file reports of ownership of the Funds’ securities and changes in such ownership with the SEC and the NYSE. Reporting Persons are also required by such regulations to furnish the Funds with copies of all Section 16(a) forms they file.

Delinquent Section 16(a) Reports

Based solely on its review of the copies of Forms 3, 4 and 5 and amendments thereto furnished to the Funds.Funds and representations of certain Reporting Persons, each Fund believes that all required Section 16(a) ownership reports were filed during its most recent fiscal year, except that one Form 4 was filed late by W. Patrick Bradley. The Adviser is responsible for overseeing the investment management and administration services providedlate Form 4 related to the Funds. The Adviser is located at One Financial Plaza, Hartford, CT 06103. The Adviserpurchase of Common Shares of ZTR on September 1, 2023. A Form 4 for the foregoing transaction has delegatedsince been filed with the day-to-day portfolio management of the NFJ fund to NFJ Group and AllianzGI US. The Adviser has delegated the day-to-day portfolio management of all other Funds to AllianzGI US. NFJ Group is an affiliate of the Adviser and, like the Adviser, an indirect wholly owned subsidiary of Virtus Investment Partners, Inc. NFJ Group is located at 2100 Ross Avenue, Suite 700, Dallas, TX 75201. AllianzGI US is located at 1633 Broadway, New York, New York 10019, and is a majority-owned indirect subsidiary of Allianz SE, a publicly traded European-based multinational insurance and financial services holding company.SEC.

Information about each Fund’s Independent Registered Public Accounting Firm.Accountant

The Audit Oversight Committee of1940 Act requires that each Fund’s Board and the full Board of each Fund unanimously selected PricewaterhouseCoopers LLP (“PwC”) as the independent registered public accounting firm be selected by the vote, cast in person, of a majority of the members of the Board who are not interested persons of the Fund. In addition, the listing standards of the NYSE vest the Audit Committee, in its capacity as a committee of the Board, with responsibility for the fiscal years ending January 31, 2021 for ACV, NIEappointment, compensation, retention and NFJ, and February 28, 2021 for NCV, NCZ, CBH and AIO. PwC served asoversight of the work of the Fund’s independent registered public accounting firm of each Fundfirm. AIO’s, CBH’s, NCV’s, NCZ’s, ACV’s, NFJ’s and NIE’s financial statements for the last fiscal year ended January 31, 2024, and also serves asVGI’s, EDF’s and ZTR’s financial statements for the year ended November 30, 2023, have been audited by PricewaterhouseCoopers LLP (“PwC”), an independent registered public accounting firm of various other investment companies for whichfirm. PwC has been selected to perform the Adviser serves as investment adviser. PwC is located at 2001 Market Street, Philadelphia, PA 19103-7042. Noneaudit of the Funds knowsfinancial statements of any directAIO, CBH, NCV, NCZ, ACV, NFJ and NIE for the year ending January 31, 2025, and of the financial or material indirect financial intereststatements of VGI, ZTR and EDF for the year ending November 30, 2024. Representatives of PwC in the Funds.

A representative of PwC, if requested by any Shareholder, willare not expected to be present at the Meeting via telephone to respond to appropriate questions from ShareholdersAnnual Meeting.

Audit Committee Report — AIO, CBH, NCV, NCZ, ACV, NFJ and will have an opportunity to make a statement if he or she chooses to do so.NIE

ReportThe Audit Committee oversees the Fund’s financial reporting process on behalf of the Audit Oversight Committee.Board of Directors or Board of Trustees of each Fund and operates under a written charter adopted by the Board. The Committee meets with the Funds’ management (“Management”) and independent registered

![[MISSING IMAGE: sg_angelaborreggine-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-078063/sg_angelaborreggine-bw.jpg)

![[MISSING IMAGE: sg_jennifersfrommnew-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-045275/sg_jennifersfrommnew-bw.jpg)